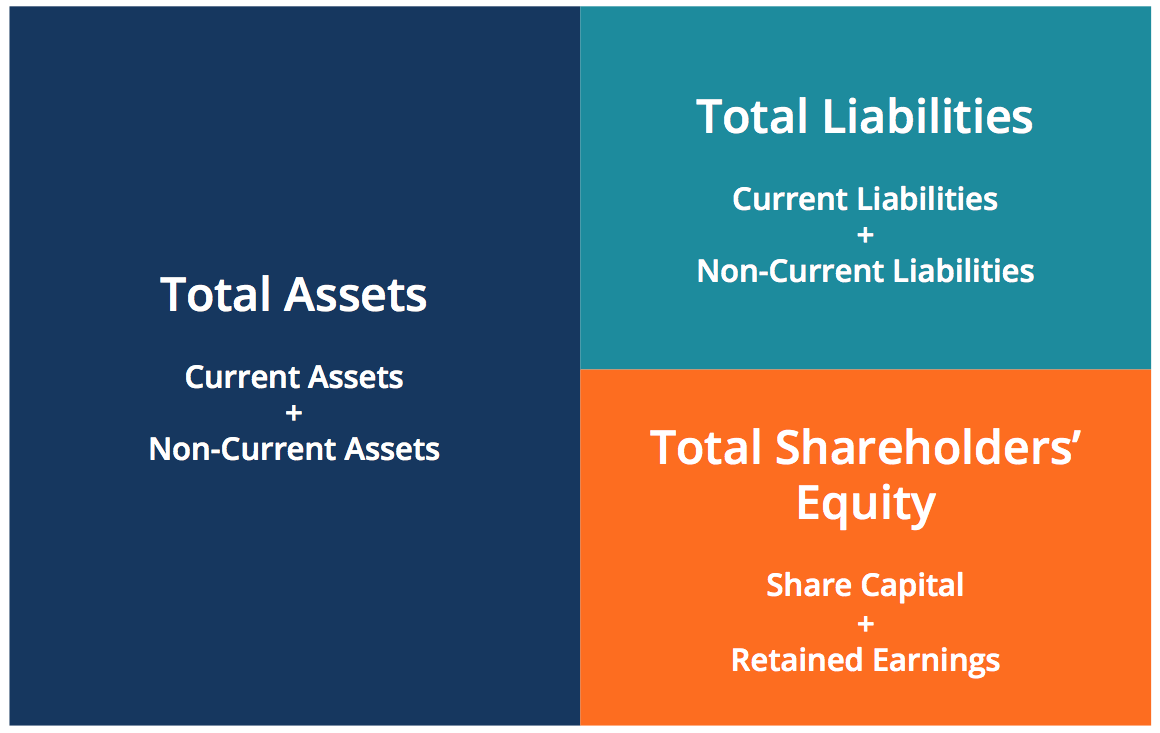

This formula also known as the balance sheet equation shows that what a company owns assets is purchased by either what it owes liabilities assets liabilities equity or by what its owners invest equity. They tell you how much you have how much you owe and whats left over. Liabilities refer to anything which the company owes. Assets liabilities equity and the accounting equation are the linchpin of your accounting system. Equity is the difference between assets and liabilitiesMy Website. The three basic elements of the balance sheet are assets liabilities and equity. Assets Liabilities and EquityIt All Equals Out. Assets are items of value which can be converted into cash. The amount of equity the owner has in the business is an important yardstick used by investors to evaluate the company. Assets are things that you own that have dollar value.

The amount of equity therefore depends on the measurement of assets and liabilities. Assets are items of value which can be converted into cash. Assets are things that you own that have dollar value. Asset classes basically stem from Cash and equivalents Property inclusive of cars. For instance lets say a lemonade stand has 25 in assets and 15 in liabilities. They help you understand where that money is at any given point in time and help ensure you havent made any mistakes recording your transactions. Equity is the residual interest in the entity calculated by subtracting liabilities from assets. Assets Liabilities and EquityIt All Equals Out. This video explains what it means to have equity in your home. Assets refer to the resources which a company owns or controls because of past events and from which future economic benefits are expected to flow.

For instance lets say a lemonade stand has 25 in assets and 15 in liabilities. The balance sheet equation also known as the accounting equation is Assets Liabilities Equity. Assets Liabilities and EquityIt All Equals Out. Equity is the difference between assets and liabilitiesMy Website. Assets liabilities equity and the accounting equation are the linchpin of your accounting system. Assets are items of value which can be converted into cash. They tell you how much you have how much you owe and whats left over. The amount of equity the owner has in the business is an important yardstick used by investors to evaluate the company. Liabilities such as accounts payable short-term and long-term debt capital leases and pensions or other retirement benefits are listed in order of when the debts come due from sooner to later. Intangibles such as goodwill are also considered to be assets.

Many times it determines the amount of capital they feel they can safely invest in the business. The full amount of assets owned by a company is know as total assets. Assets are things that you own that have dollar value. Liabilities refer to anything which the company owes. Liabilities are the debts you owe. Assets can be fixed or liquid asset. Intangibles such as goodwill are also considered to be assets. The amount of equity therefore depends on the measurement of assets and liabilities. In this case the equity would be 10. The basic accounting equation states that Assets Liabilities Equity.

Many times it determines the amount of capital they feel they can safely invest in the business. Story continues Liabilities. Assets Liabilities and EquityIt All Equals Out. The assets are 25 the liabilities equity 25 15 10. Assets can be fixed or liquid asset. Assets refer to the resources which a company owns or controls because of past events and from which future economic benefits are expected to flow. The amount of equity therefore depends on the measurement of assets and liabilities. They tell you how much you have how much you owe and whats left over. Assets liabilities equity and the accounting equation are the linchpin of your accounting system. Liabilities are the debts you owe.